Emergency Cash Backup Thailand: Before Crisis Hits

Living as an expat in Thailand brings incredible rewards, but I’ve learned that financial preparedness can make or break your experience here. After witnessing several banking system disruptions and helping countless expats navigate cash crises, I understand how crucial it is to have a solid emergency cash backup plan. Whether you’re in Bangkok’s bustling streets or Phuket’s beaches, running out of cash during a banking emergency isn’t just inconvenient—it can be genuinely dangerous.

Key Takeaways

- Multiple cash sources and backup plans prevent financial disasters during unexpected banking disruptions in Thailand

- Understanding ATM withdrawal limits, fees, and alternative money access methods ensures continuous cash flow during emergencies

- Building relationships with local Thai banks and maintaining diverse payment options provides crucial financial security for expats

Understanding Thailand’s Banking Landscape

Thai Banking System Vulnerabilities

Thailand’s banking infrastructure, while generally reliable, faces occasional disruptions that can leave expats scrambling for cash. I’ve seen everything from ATM network failures affecting multiple banks simultaneously to international payment processing delays that strand tourists and residents alike.

The Thai financial system relies heavily on cash transactions, especially with street vendors and in smaller towns. When banking systems experience problems, having alternative access to money becomes critical for basic needs like food, transportation, and medical expenses.

ATM Limitations and Daily Withdrawal Limits

Most ATMs in Thailand impose daily withdrawal limits that vary by bank and card type. Local Thai bank cards typically allow higher withdrawals than foreign cards, which often cap at 20,000-30,000 baht per day. During emergencies, these limits can feel severely restrictive.

ATM fees add another layer of complexity. Foreign cards face charges from both your home bank and the local Thai bank, sometimes totaling 300-500 baht per transaction. Multiple ATM visits during a crisis quickly become expensive.

Building Your Emergency Cash Backup Thailand Strategy

Diversifying Your Money Access Points

I recommend maintaining at least three different ways to access cash in Thailand. This might include a local Thai bank account, an international debit card with low fees, and a travel card loaded with Thai baht.

Opening a Thai bank account requires proper visa documentation, but the investment pays dividends during emergencies. Local accounts offer higher withdrawal limits, lower fees, and faster access to funds during banking disruptions.

Cash Storage and Management

Keeping some physical cash on hand remains essential, despite Thailand’s growing cashless payment adoption. I suggest maintaining emergency funds equivalent to one month’s basic expenses in Thai baht, stored securely across multiple locations.

Large denominations like 1,000 baht notes work well for storage efficiency, but keep smaller bills (100 and 500 baht) for daily transactions. Many vendors prefer cash and may not have change for larger bills.

ATM Strategy for Thailand Travel and Living

Finding Reliable ATMs in Bangkok and Major Cities

Bangkok offers extensive ATM coverage, with machines from major banks like Kasikorn, Bangkok Bank, and Siam Commercial Bank throughout shopping malls, BTS stations, and commercial areas. I’ve found that ATMs in shopping malls tend to be more reliable and secure than standalone units.

Bank branches typically offer the most dependable ATM access, especially during system-wide issues. Major banks maintain 24-hour service areas in central Bangkok locations.

ATM Fees and Exchange Rate Considerations

Always choose to be charged in Thai baht rather than your home currency when using ATMs. Dynamic currency conversion often includes hidden fees and poor exchange rates that can cost 3-5% extra per transaction.

Research your home bank’s international ATM fee structure before traveling. Some banks reimburse ATM fees, while others charge significant amounts. Travel cards specifically designed for international use often offer better rates than standard debit cards.

Phuket and Tourist Area Considerations

Tourist areas like Phuket present unique challenges for cash access. ATMs experience heavier usage and sometimes run out of cash, particularly during peak tourism seasons. Hotel ATMs often charge premium fees, so seek out bank-operated machines when possible.

Western Union and other money transfer services provide backup options in tourist areas, though fees can be substantial. These services become valuable during extended banking disruptions when ATM access remains limited.

Alternative Emergency Funding Sources

Money Transfer Services and Wire Transfers

When traditional banking fails, money transfer services offer crucial backup options. Western Union, MoneyGram, and similar services operate throughout Thailand, with locations in most shopping malls and commercial areas.

Bank wire transfers through Thai bank branches provide another emergency option, though processing times vary. Establish relationships with local bank managers who can expedite urgent transfers during crises.

Travel Insurance and Emergency Financial Support

Comprehensive travel insurance should include emergency cash advance provisions. Many policies provide emergency funds when you can’t access your regular banking services, though activation procedures require advance planning.

Keep insurance policy details and emergency contact numbers readily accessible. Digital copies stored in cloud services ensure access even if physical documents are lost.

Credit Card Cash Advances

While expensive, credit card cash advances provide emergency access when other options fail. Visa and Mastercard acceptance remains widespread in Thailand, though cash advance fees and interest rates make this a last-resort option.

American Express services are more limited in Thailand, particularly outside Bangkok and major tourist areas. Don’t rely solely on Amex for emergency cash access.

Technology and Digital Banking Solutions

Banking Apps and Mobile Access

Thai banking apps offer convenient account management and money transfer capabilities, but require stable internet connections. Download and configure apps before emergencies occur, ensuring you understand navigation and security procedures.

International banking apps may face access restrictions in Thailand. VPN services can help maintain connectivity to home banking systems, though some banks actively block VPN usage.

Cashless Payment Backup Options

Thailand’s growing cashless infrastructure includes PromptPay, TrueMoney, and various e-wallet services. While useful for everyday transactions, these systems depend on the same banking infrastructure that may fail during crises.

Maintain both digital and physical payment options. QR code payments work well for many vendors, but cash remains king during infrastructure disruptions.

Regional Considerations Across Thailand

Chiang Mai and Northern Thailand

Northern Thailand’s banking infrastructure is less dense than Bangkok or southern tourist areas. ATM availability decreases in rural areas, and banking hours may be more restrictive.

Plan cash needs more carefully when traveling to smaller towns around Chiang Mai. Bank branches in remote areas may close earlier or have limited weekend hours.

Southern Thailand and Island Areas

Island destinations often face unique cash access challenges. Ferry schedules can delay banking services, and ATM maintenance becomes more complex on remote islands.

Stock up on cash before traveling to smaller islands. While larger destinations like Phuket maintain good banking infrastructure, smaller islands may have limited or unreliable ATM access.

Emergency Protocols and Crisis Management

What to Do When Banking Systems Fail

During widespread banking disruptions, prioritize essential expenses like food, shelter, and transportation. Avoid unnecessary spending until normal services resume.

Contact your home bank immediately to report access issues and explore alternative solutions. Many banks maintain emergency hotlines specifically for international travelers facing access problems.

Communication and Documentation

Maintain copies of all banking information, including account numbers, emergency contact details, and insurance policy information. Store both physical and digital copies in separate locations.

Keep embassy contact information readily available. Consular services can provide emergency assistance and coordinate with local authorities during significant banking crises.

Building Long-term Financial Security in Thailand

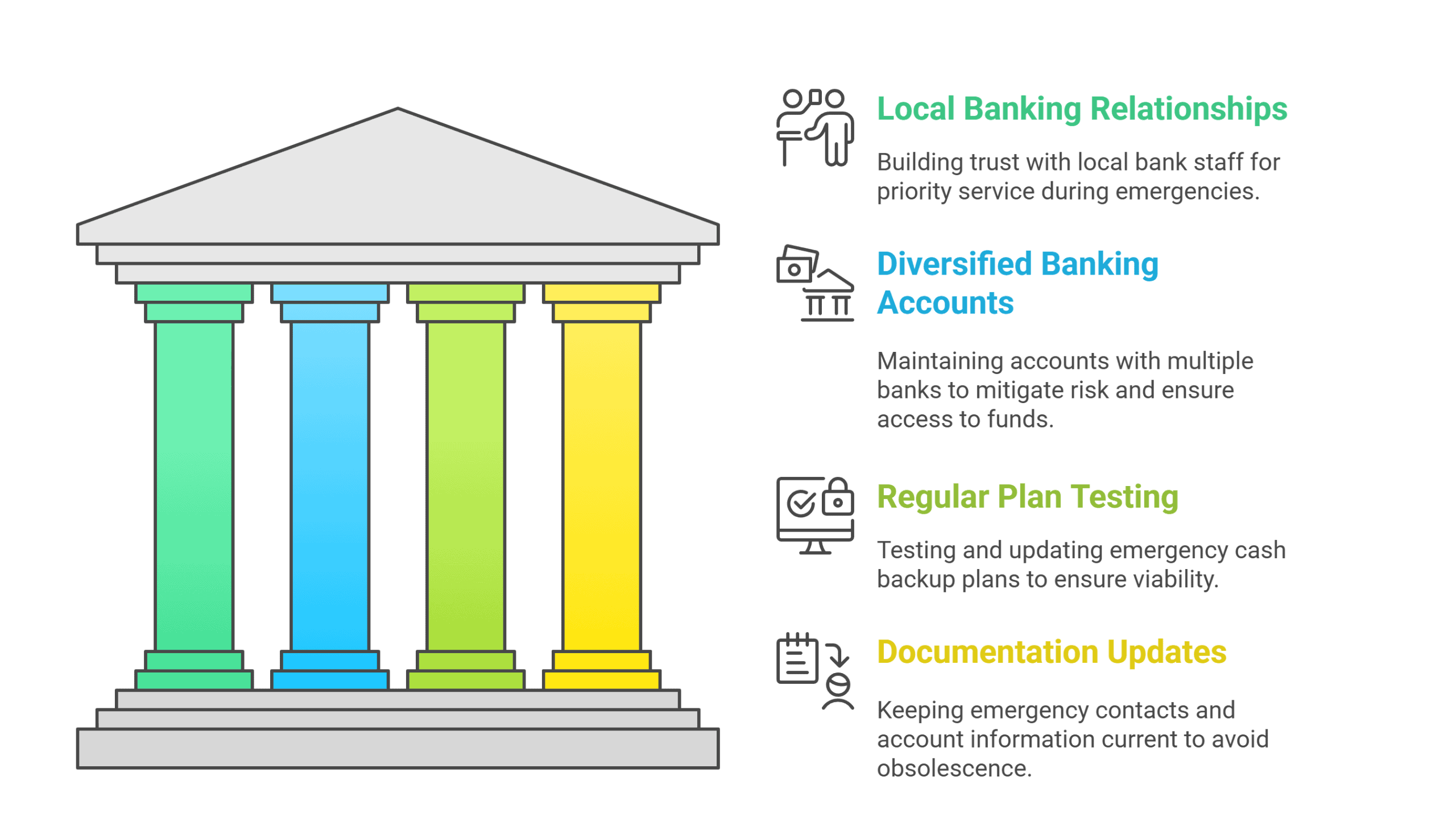

Establishing Local Banking Relationships

Developing relationships with local Thai bank staff pays significant dividends during emergencies. Regular customers often receive priority service and assistance during challenging situations.

Consider maintaining accounts with multiple Thai banks to diversify risk. Different banks use different systems and may remain operational when others experience problems.

Regular Plan Testing and Updates

Test your emergency cash backup plan regularly by accessing funds through different methods. Verify that cards work, apps function properly, and backup options remain viable.

Update emergency contacts, account information, and documentation as circumstances change. Plans become obsolete quickly without regular maintenance.

FAQs

How much cash should I keep on hand as an expat in Thailand?

Which Thai banks offer the best services for expats?

Can I use my foreign debit card reliably throughout Thailand?

What should I do if my cards stop working during a trip?

Are mobile banking apps safe to use in Thailand?

Conclusion

Creating a robust emergency cash backup plan isn’t just smart—it’s essential for any expat serious about thriving in Thailand. I’ve seen too many people caught unprepared when banking systems hiccup or cards suddenly stop working. The strategies I’ve shared come from real experience helping expats navigate these exact situations.

Don’t wait until you’re stuck without cash to build these safety nets. If you’re planning your move to Thailand or want to bulletproof your current financial setup, Better Living Asia is here for you. Schedule a consultation with Better Living Asia today, and I’ll help you create a personalized emergency plan that fits your specific situation and gives you genuine peace of mind.